How Financial Offshore Solutions Can Enhance Your Wealth Protection Plan

How Financial Offshore Solutions Can Enhance Your Wealth Protection Plan

Blog Article

Checking Out the Key Benefits of Utilizing Financial Offshore Provider

In the realm of worldwide money, the tactical use of offshore financial services provides unique benefits, particularly in the locations of tax optimization and possession protection. financial offshore. Jurisdictions providing low tax prices and robust privacy regulations attract firms and people alike, looking for to boost earnings while protecting their riches. These solutions not only make certain confidentiality but also offer a platform for varied financial investment chances that can result in substantial financial development. This exploration elevates crucial questions about the sensible and ethical effects of such economic strategies.

Tax Obligation Optimization Opportunities in Offshore Jurisdictions

While checking out monetary overseas solutions, one significant advantage is the tax obligation optimization opportunities offered in overseas territories. These areas frequently have positive tax obligation laws made to bring in foreign investment, which can dramatically lower the tax obligation worry for people and corporations. For instance, many offshore financial facilities impose no funding gets taxes, no estate tax, and supply low business tax obligation prices. This legal method for tax management enables people and entities to assign sources effectively, possibly improving success and growth.

Additionally, jurisdictions such as the Cayman Islands, Bermuda, and the Isle of Man are renowned for their affordable tax obligation regimes. They offer a lawful structure that promotes global service operations without the hefty taxation common in the financiers' home countries. Using these possibilities calls for cautious planning and adherence to international tax legislations to ensure conformity and make best use of benefits, making the know-how of specialized economic experts vital in navigating the complexities of overseas economic tasks.

Enhancing Privacy and Possession Defense With Offshore Solutions

Several people and firms turn to overseas services not only for tax benefits but likewise for enhanced personal privacy and property security. Offshore territories usually have stringent confidentiality laws that stop the disclosure of monetary and individual information to third celebrations. By placing possessions in offshore counts on or business, they can legitimately protect their riches from financial institutions, claims, or expropriation.

Diversity and Risk Monitoring With International Financial Platforms

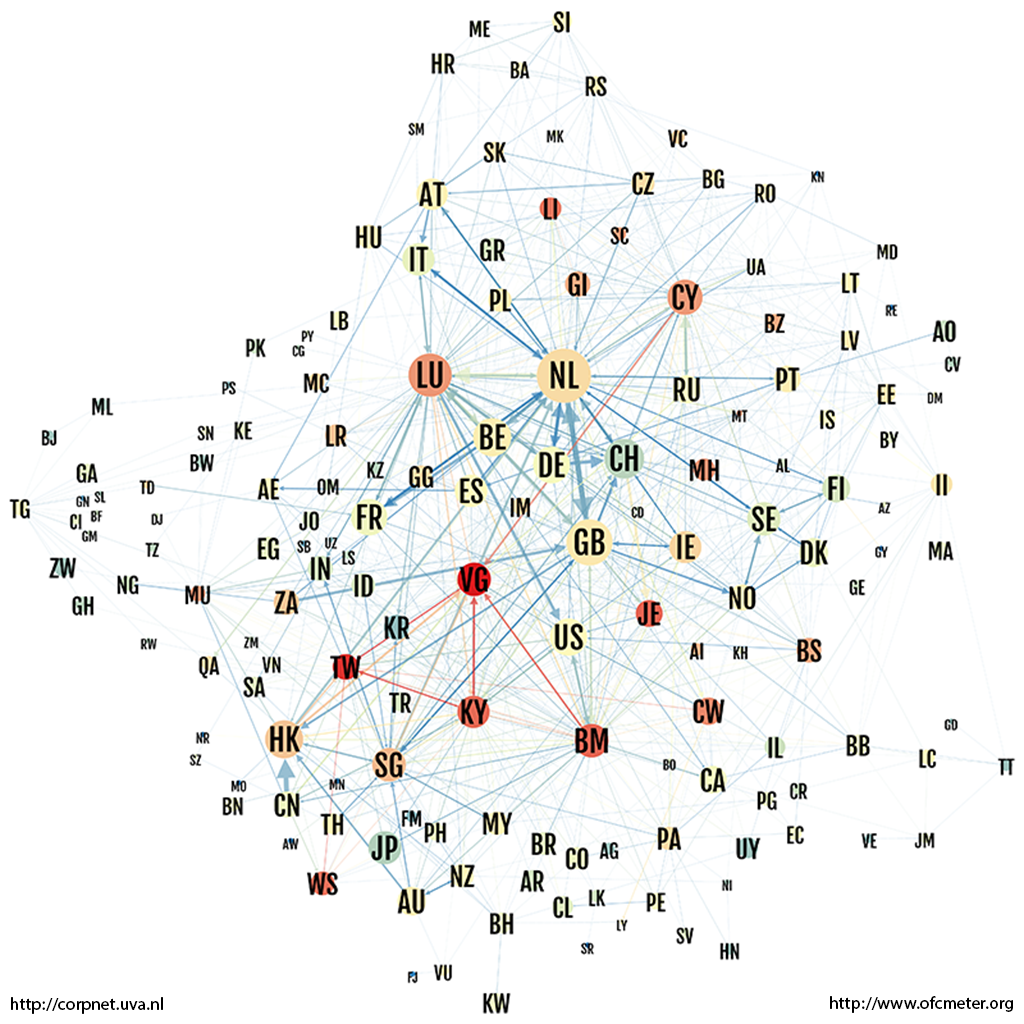

In enhancement to enhancing privacy and asset security, offshore economic services offer considerable possibilities for diversity and threat management. By designating assets throughout different international markets, capitalists can decrease the effect of local volatility and systemic risks. This worldwide spread of investments aids reduce potential losses, as unfavorable economic or political explanation advancements in one region may be balanced by gains in an additional.

Furthermore, the use of international monetary platforms can offer advantageous currency direct exposure, improving portfolio performance through money diversification. This approach exploits on variations in money worths, potentially balancing out any type from this source of residential money weak points and further maintaining financial investment returns.

Final Thought

To conclude, financial offshore solutions existing considerable advantages for both people and organizations by providing tax obligation optimization, boosted personal privacy, property defense, and risk diversification. These services assist in strategic financial preparation and can cause significant development and conservation of riches. By leveraging the unique benefits of offshore jurisdictions, stakeholders can accomplish a more efficient and safe management of their monetary resources, customized to their details requirements and objectives.

In the realm of worldwide money, the tactical use of offshore economic solutions presents distinctive advantages, particularly in the locations of tax obligation optimization and asset security.While exploring economic overseas solutions, one substantial advantage is the tax optimization possibilities offered in offshore jurisdictions. Several offshore next page financial facilities impose no capital gains tax obligations, no inheritance tax obligations, and provide low corporate tax obligation rates - financial offshore. Making use of these chances calls for cautious preparation and adherence to international tax obligation laws to ensure conformity and make best use of benefits, making the knowledge of specialized financial consultants important in navigating the complexities of offshore economic tasks

Report this page